4.4 Q9: Impact of High-profile Events on Community and Market Attitudes

[🔗Github Link]

4.4.2 Causal Inference with the DoubleML estimator

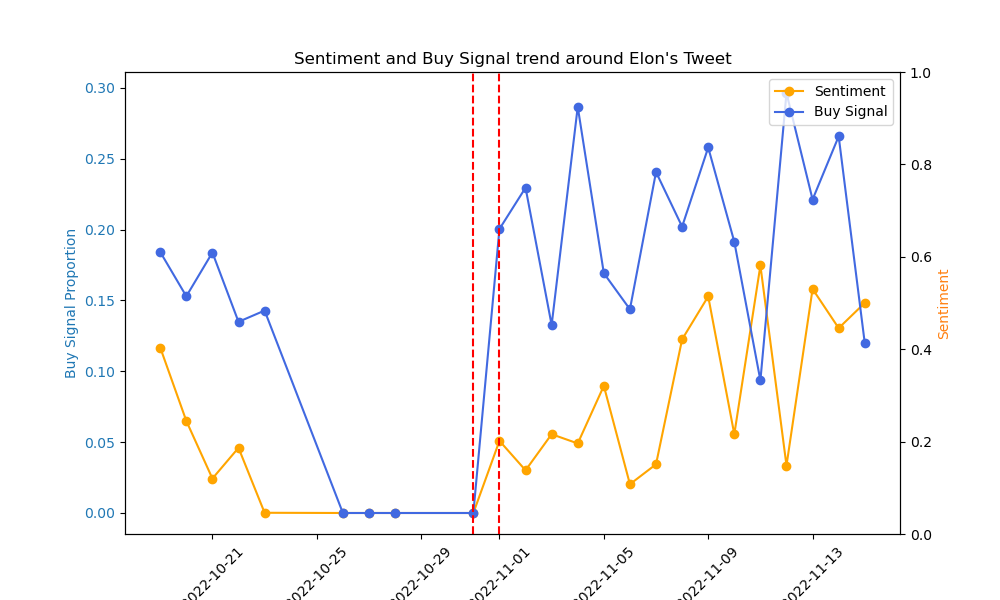

We define a period of 14 days before and after the tweet on November 1, 2022, to analyze changes in community behavior.

Treatment: Before or After Tweet Post Outcome: Average Sentiment/ Buy Signal Proportion

| Treatment Effect | Confidence Interval | If Casual | |

|---|---|---|---|

| Sentiment | 0.06 | (0.0376, 0.0824) | Yes |

| Buy Signal | 0.324 | (0.1141, 0.4499) | Yes |

The analysis reveals a moderate treatment effect on sentiment (0.06), indicating that while Musk’s tweet positively influenced the sentiment within the Dogecoin community, the impact was modest yet statistically significant. This suggests that influential tweets may sway public sentiment but typically do not cause drastic changes unless paired with significant market developments.

Conversely, the effect on buy signals was substantially stronger (0.324), pointing to a more marked behavioral response in terms of investment and trading activities. This larger effect size highlights the power of prominent social media figures to initiate substantial market actions, likely fueled by perceived endorsements or speculative optimism following the tweet.

Overall, the evidence supports a causal relationship between Musk’s tweet and changes in both sentiment and buying behavior within the Dogecoin community on Reddit. These findings underscore the broader impact of social media on cryptocurrency markets, where a single influential post can significantly alter market dynamics and investor behavior.